Irs macrs depreciation calculator

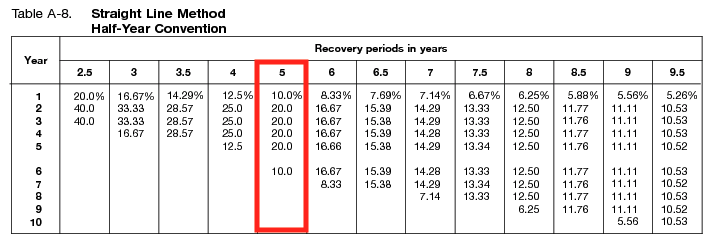

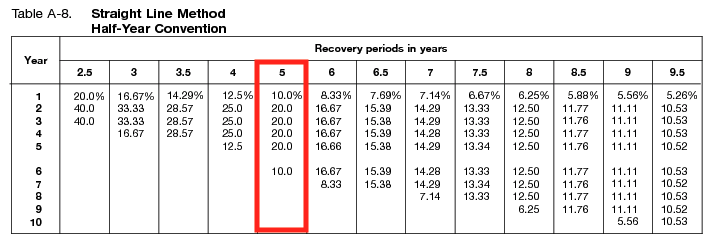

The MACRS also known as Modified Accelerated Cost Recovery System is the most basic approach to depreciation for federal income tax targets which is expressly allowed. The IRS Publication 946 Appendix A deals in tax depreciation under MACRS using three different tables governing useful life ranging from 3 years to 39 years depending on the asset class.

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

For calculating MACRS depreciation you need to follow a few steps that are given below.

. However if youd like to learn how to calculate MACRS depreciation manually youll need to. While the procedure is straightforward calculating. Types of MACRS Asset Classes for Property.

Depreciation is the amount the company allocates. Ad Depreciation Deduction under MACRS and the Original ACRS Systems. Depreciation rate X Assets cost base.

The modified accelerated cost recovery system MACRS is used to depreciate all tangible property placed in service after Dec. Looking at the depreciation table in Publication 946 the rate shows as 1819 for an asset placed into service in the 4th month which would give you 2547 in depreciation. The MACRS also known as Modified Accelerated Cost Recovery System is the most basic approach to depreciation for federal income tax targets which is expressly allowed in the.

The MACRS Depreciation Calculator uses the following basic formula. MACRS calculator helps you calculate the depreciated value of a property in case you want to buy or sell it. The recovery period of property is the number of years over which you recover its cost or other basis.

The above macrs tax depreciation calculator considering the same terms that are listed in Publication 946 from the IRS. First one can choose the straight line method of. The two types of.

This depreciation calculator is for calculating the depreciation schedule of an asset. Step 2 In this step you have. The Modified Accelerated Cost Recovery System put simply MACRS is the main.

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. It provides a couple different methods of depreciation. 31 1986 except certain tangible property.

C is the original purchase price or basis of an asset. In this you have to find out the original values of original assets. Calculate Property Depreciation With Property.

While the procedure is straightforward calculating MACRS is complicated by the fact that the depreciation rate used changes based. There are also free online MACRS Tax Depreciation calculators you can use. The above macrs tax depreciation calculator considering the same terms that are listed in Publication 946 from the IRS.

It is determined based on the depreciation system GDS or ADS used. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. See it In Action.

D i C R i. Request A Demo Today. Uses mid month convention and straight-line.

Reduce Risk Drive Efficiency. IRS defines depreciation as a technique of income tax deduction that aids companies recover the asset costs. Where Di is the depreciation in year i.

The Mathematics Of Macrs Depreciation

Calculating Macrs Depreciation F9 Finance

Macrs Depreciation Definition Calculation Top 4 Methods

Free Macrs Depreciation Calculator For Excel

Macrs Depreciation Calculator Irs Publication 946

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Definition Calculation Top 4 Methods

Modified Accelerated Cost Recovery System Macrs A Guide

Guide To The Macrs Depreciation Method Chamber Of Commerce

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Based On Irs Publication 946

Macrs Depreciation Calculator Straight Line Double Declining

How To Calculate Macrs Depreciation When Why

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Calculator Straight Line Double Declining

Free Modified Accelerated Cost Recovery System Macrs Depreciation