Retirement asset allocation calculator

Asset Allocation 100 A. The asset allocation is designed to help you create a balanced portfolio of investments.

Asset Allocation The Ultimate Guide For 2021

Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more.

. Do you have enough money. The old rule of thumb used to be that you should subtract your age from 100 - and thats the percentage of your portfolio that you should keep in stocks. Investments Include Mutual Funds College Savings Plans Personalized Portfolios More.

We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and. The total you end up working with. Ad Youve worked your whole life to build wealth for retirement.

Home financial retirement calculator. Get a second opinion on your financial situation with your best interest in mind. The asset allocation is designed to help you create a balanced portfolio of investments.

Ad Learn More About American Funds Objective-Based Approach to Investing. Asset allocation is designed to help you create a balanced portfolio of investments. Age ability to tolerate risk and several other factors are used to calculate a desirable mix of.

Learn how our easy-to-use investment calculators and retirement tools can help you strengthen financial strategy. Ad A Retirement Calculator To Help You Plan For The Future. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

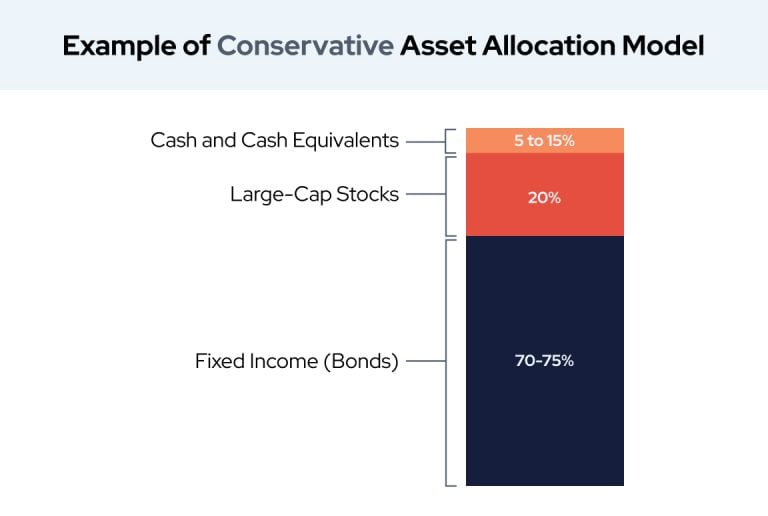

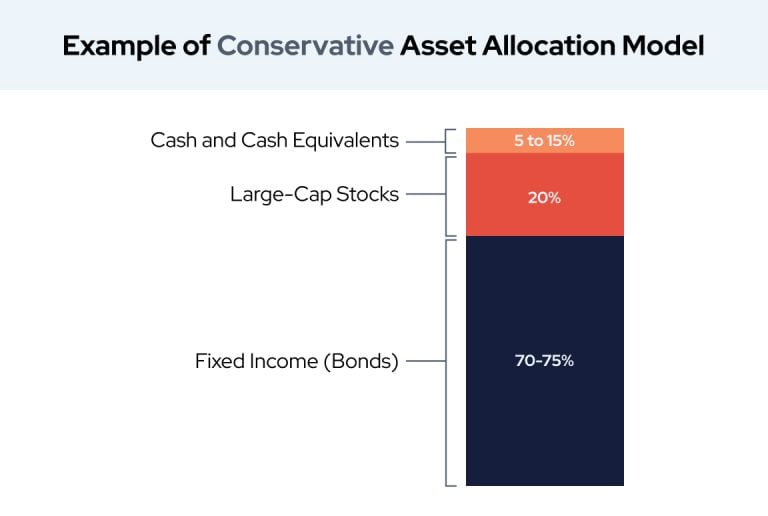

Your financial plan at 65 when you may have many more. This risk profile is a sample only. The Asset Allocation Calculator is designed to help create a balanced portfolio of investments.

The Bucket Investors Guide to Setting Asset Allocation for Retirement. This means that your needs will generally change as your retirement goes on so your asset allocation should too. Ad Search For Info About Retirement asset allocation calculator.

Factors to Help Calculate a Good Retirement Income for You. The Modern Way to Track Manage Your Money. Ad Evaluate Your Retirement Savings Find Hidden Fees.

Your employer needs to offer a 401k plan. Ad Learn More About American Funds Objective-Based Approach to Investing. Your age ability to tolerate risk and several other factors are used to calculate.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Free calculators that help with retirement planning with inflation social security life expectancy and many more factors being taken into account. Investing calculators tools.

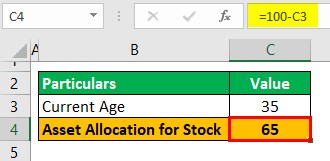

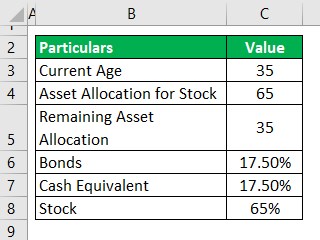

From the homepage select the link for backtest asset allocation if you want to choose from inputs such as US large cap or click the link for backtest portfolio if you would. Per the above rule of thumb formula the allocation toward risky assets should be 65 as the time frame to invest in 30 years and the remaining. 100 35.

See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing. Use this calculator to estimate the income youll have every month during retirement based on. The Rule of 100 says subtract your age from 100 and the answer is how.

Ad Leverage Our Time-Tested Investment Process And Active Management Expertise. Rule of 100. Your age ability to tolerate risk and several other factors are used to calculate a desirable mix of stocks.

The proper asset allocation for your situation may differ. Your age ability to tolerate risk and several other factors are used to. Everyone works with a different amount of income during their retirement.

Ad We Can Help You Invest For Goals Like Retirement College Or A Vacation Home. He has worked in the retirement-plan industry since 2012 and is currently the in house IT liaison. Models Built For Your Objectives To Help Financial Advisors Their Clients Succeed.

The most famous rule for asset allocation in your retirement account is the Rule of 100. Can take over in determining the appropriate asset allocation. How much can you expect in monthly income when you retire.

A Retirement Calculator To Help You Discover What They Are. Sign Up in Seconds Its Free. In applying any one of the profiles to your individual situation you also should consider your other.

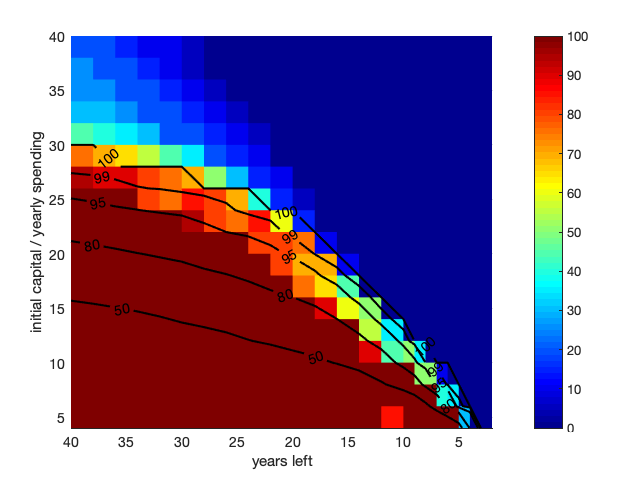

Sampling an array of opinions from target-date funds geared toward investors in your same age band. His duties include system design projects and implementation as well as system. For the default market parameters a value of 18 or higher effectively imposes no constraints.

Download this must-read guide about retirement income from Fisher Investments. For example if you earn 2000week your annual income is calculated by. Browse Get Results Instantly.

Ad Get your free no-obligation financial review meeting collaborate with advisors. See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing.

Asset Allocation Calculator Cnn Learning How To Invest Money

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Optimal Asset Allocation Strategies For Retirement Saving Bogleheads Org

The Proper Asset Allocation Of Stocks And Bonds By Age

The Proper Asset Allocation Of Stocks And Bonds By Age

What Is Asset Allocation How Is It Important In Investing

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

/GettyImages-484824862-5f1e4413297a4142915c70dd933e5432.jpg)

How To Achieve Optimal Asset Allocation

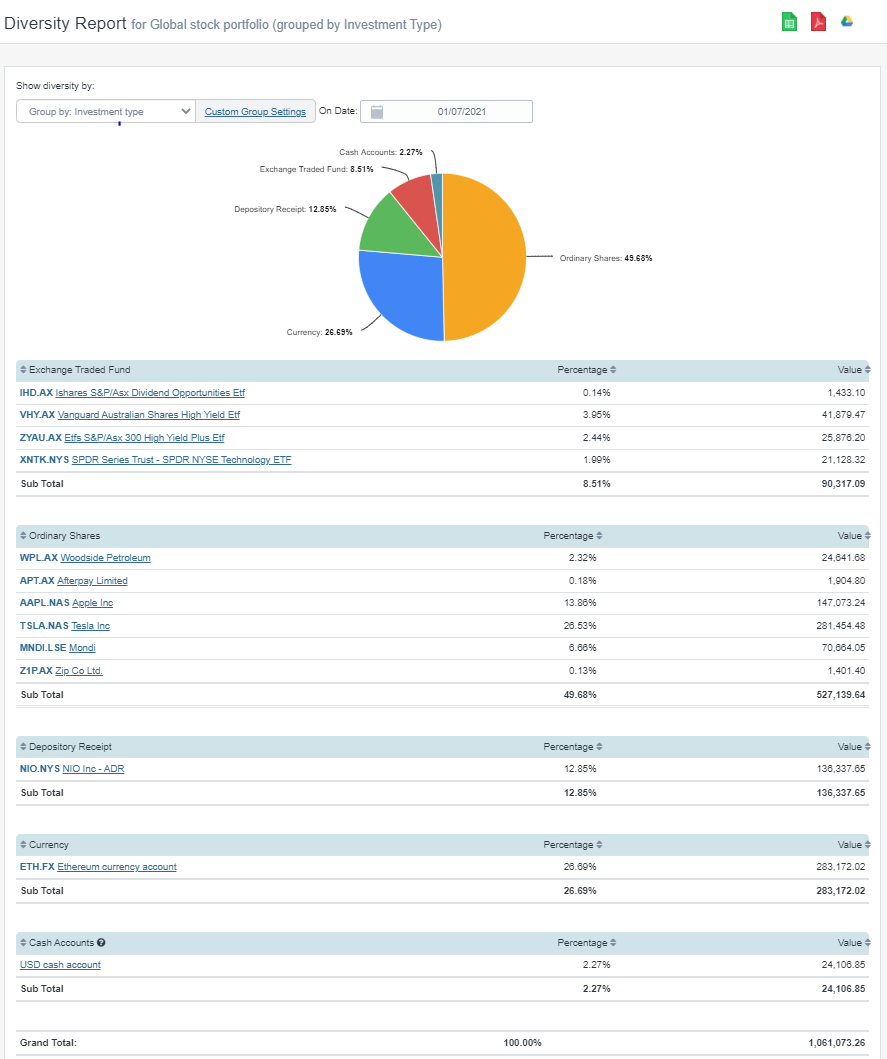

Calculate Your Investment Portfolio Diversification With Sharesight

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Asset Allocation Spreadsheet Excel Template White Coat Investor

Asset Allocation The Ultimate Guide For 2021

/the-5-percent-rule-of-investment-allocation-2466542_FINAL-f143cd6bc6a64b22a80f75a610da985e.gif)

Learn The 5 Rule Of Investing

Asset Allocation Calculator Allocate The Assets Using Thumb Rule

Asset Allocation Calculator Allocate The Assets Using Thumb Rule

How To Maintain Proper Asset Allocation With Multiple Investing Accounts